Heartwarming Tips About How To Claim Cca

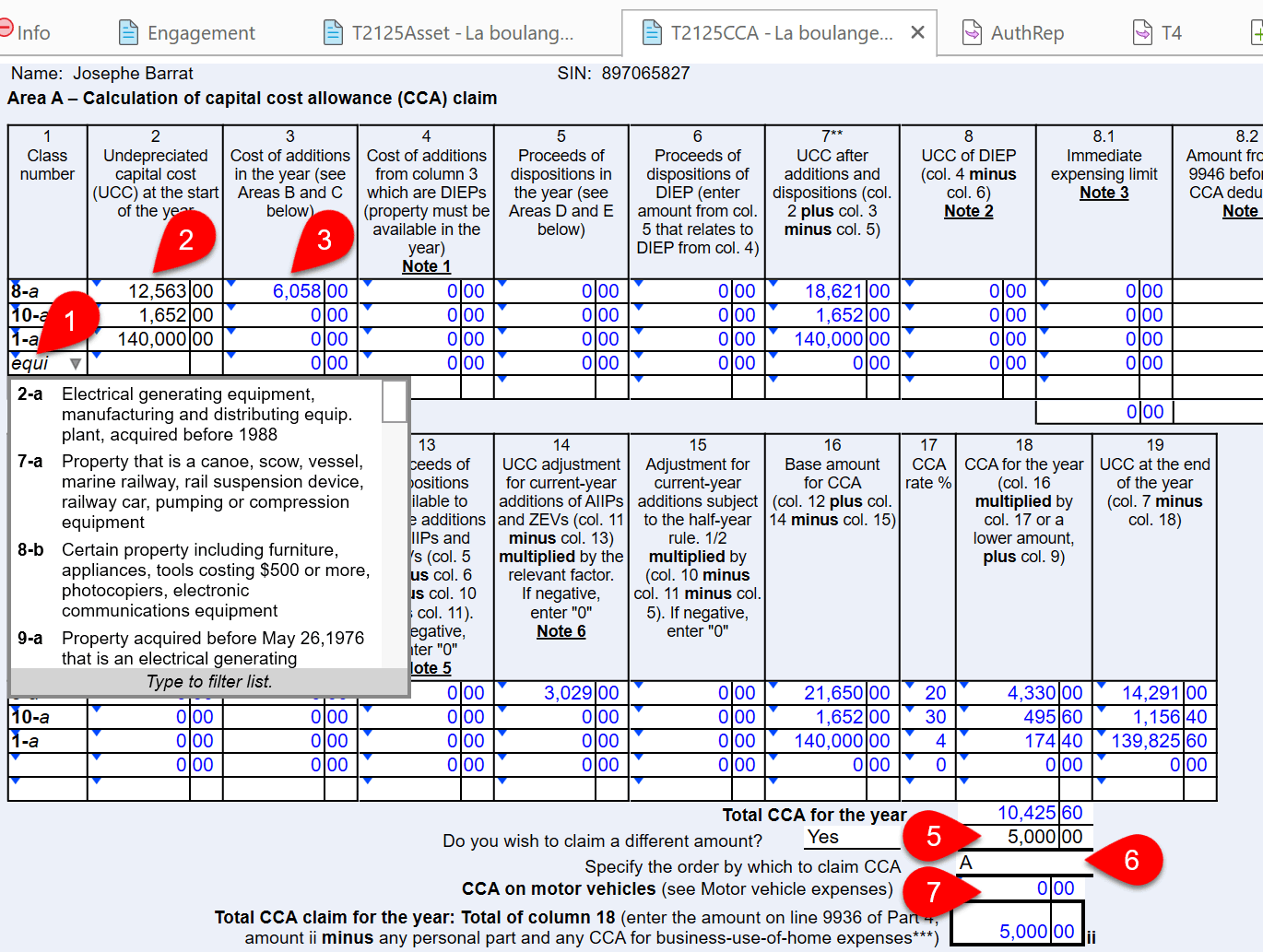

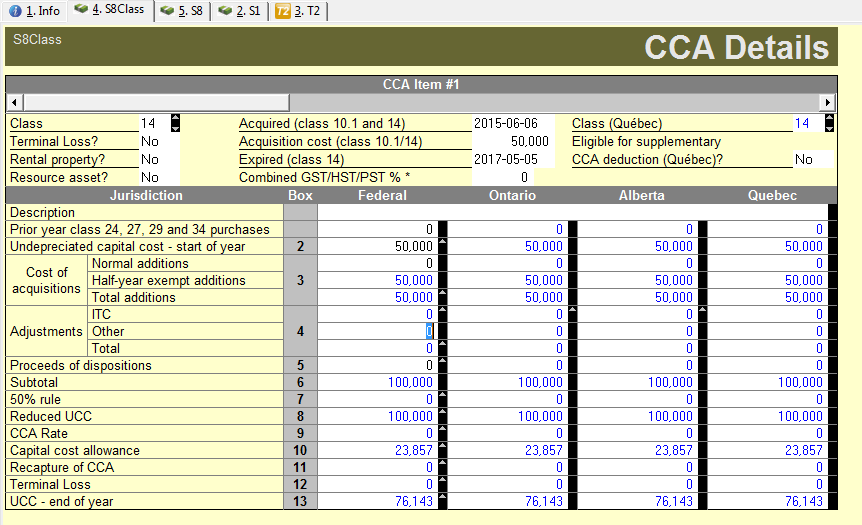

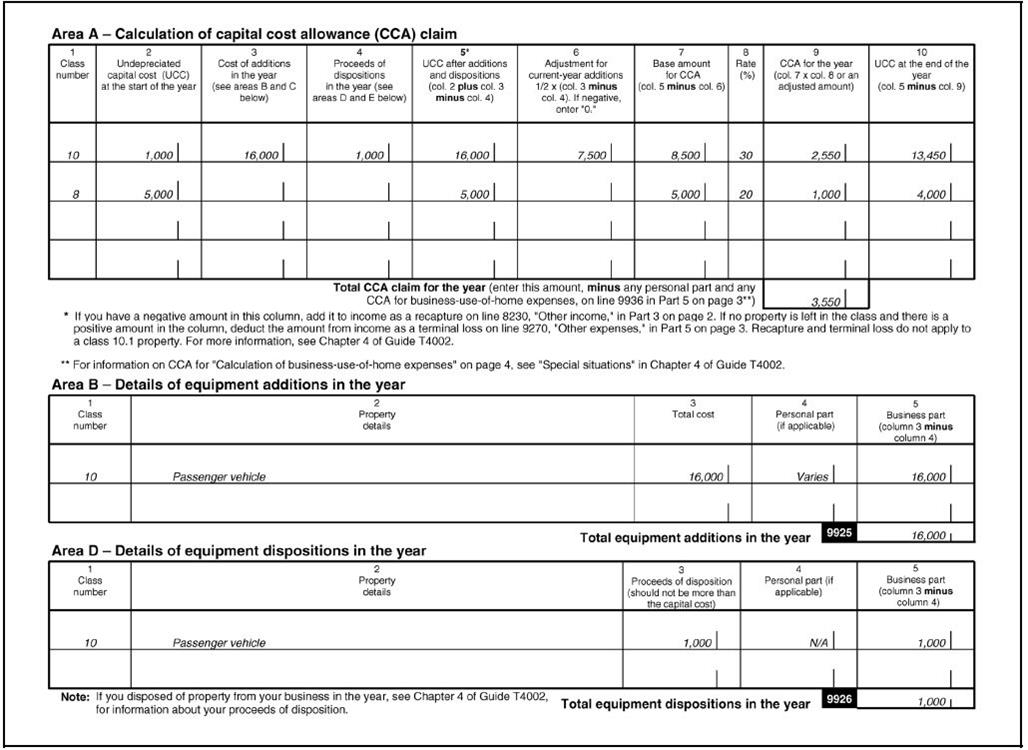

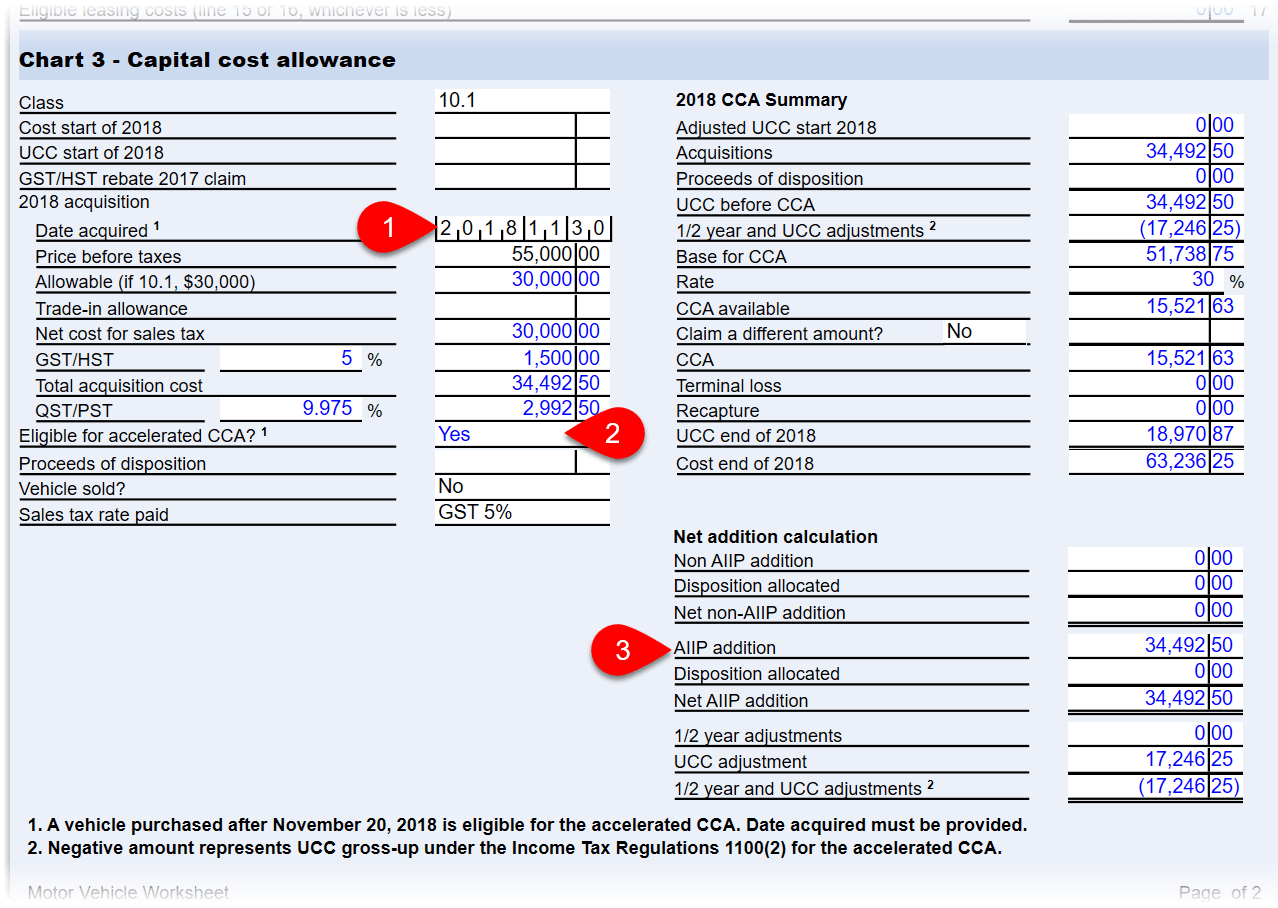

Acquiring an asset example 2:

How to claim cca. How to claim cca on form t2125. Instead, you can claim as much. If you are a sole proprietor or a member of a partnership, you can claim the cca on line 9936 of form t2125.

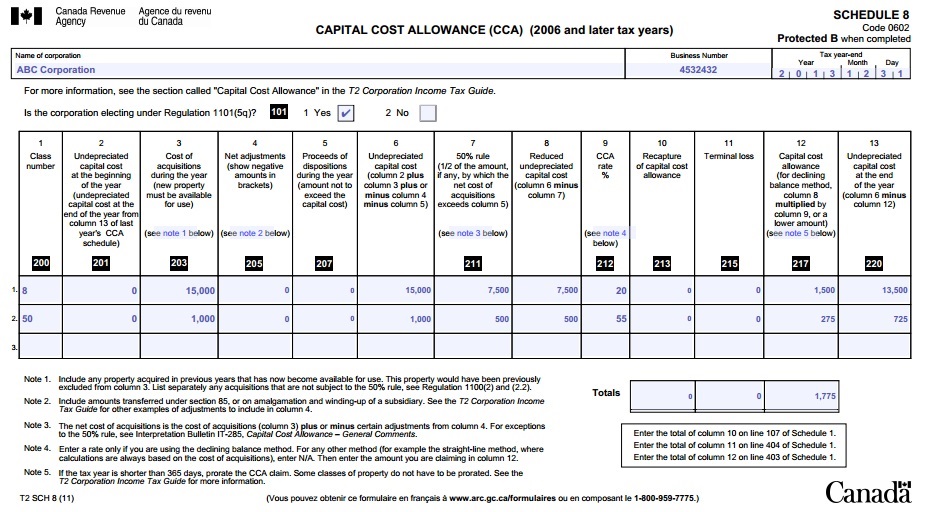

Claiming a cca is completely optional. Complete form t776 to claim your cca. Capital cost allowance (cca) helps businesses cover the cost of asset depreciation at varying rates over time.

You don’t have to claim the full amount of the cca in the particular year your assets depreciate. Capital cost allowance (cca) allows canadian businesses to annually claim depreciation expenses for capital assets under the income tax act. Suppose you calculate your cca to be $3,500.

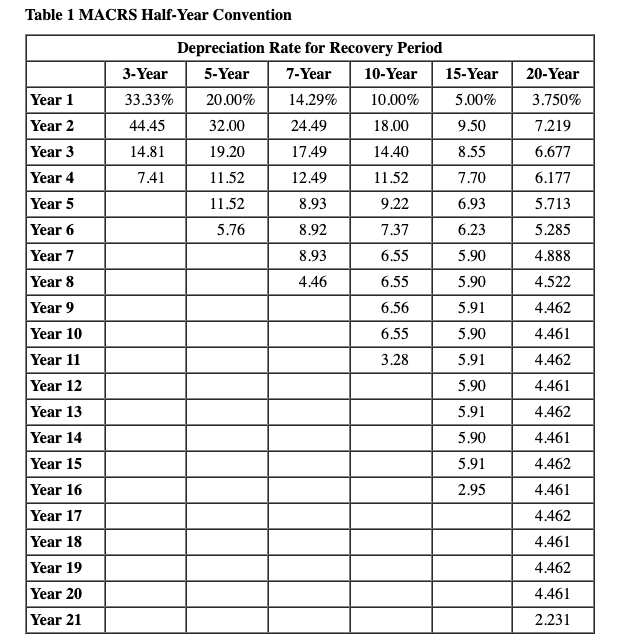

Claiming cca throughout the lifespan example 3: How to claim a capital cost allowance. Capital cost allowance (cca) is a tax deduction that canadian businesses can claim for the decline in the value of their capital assets over time.

The amount of cca you can claim is $2,052 ($3,500 × 214/365). Note that you do not need to claim the maximum cca you are entitled to in a given year. You can elect to carry any unclaimed portion of your cca over to a future year.

This allows rental property owners to avoid. Disposing of an asset making capital claims on your tax return cca. And when you don’t have enough taxable income to make use of the full.

If you have capital cost allowance to declare on your 2020 federal tax return, turbotax canada is here to help!

:max_bytes(150000):strip_icc()/GettyImages-511153369-57a0f7fb5f9b589aa9f17152.jpg)