Amazing Info About How To Get Out Of An Arm Loan

Adjustable rate mortgage (arm):

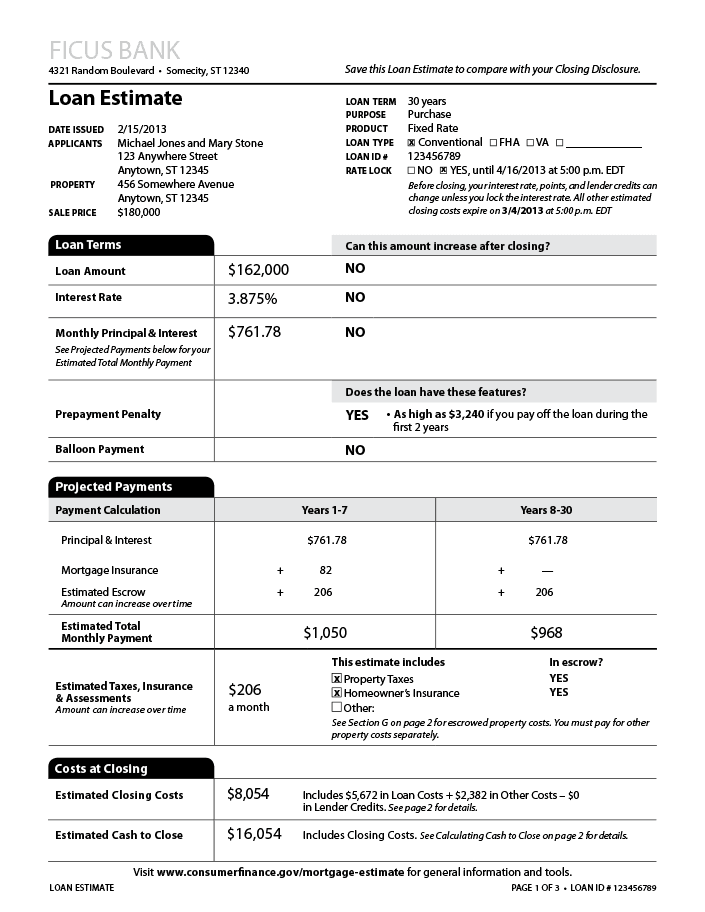

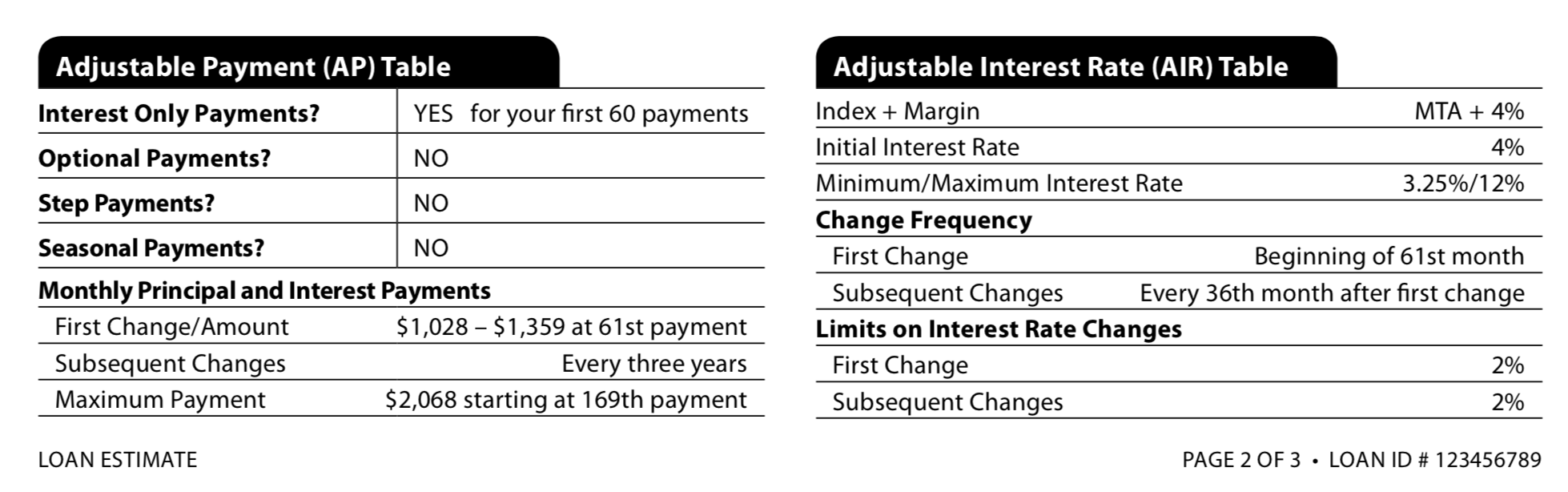

How to get out of an arm loan. Today’s current arm rates are as follows: With a strong reputation for. You can use arms for conventional financing via fannie mae and freddie mac;

Can you refinance an arm loan? Refinancing to buy yourself out of the loan. And with fha loans and va loans, too.

Getting out of an arm is difficult often because a property ends up being under water. If something looks different from what you expected, ask your lender why. You’ll need to meet credit.

Gather proof of your financial. Here are the steps to follow if you want to pursue an arm loan modification: An adjustable rate mortgage (arm) can be a great home loan option for certain homeowners.

Arms are home loans whose rates can vary over the life of the loan. Pros of arms.